In 2016 I collaborated with a Financial Resilience team to investigate ways of helping vulnerable 50-64 year-olds improve their financial situation by tracking their finances and saving money.

OPPORTUNITY

Give older adults the tools to control their money

How can the organization help older, vulnerable Americans become more financially secure by addressing postponing saving for retirement, debt and gaining control of their money? Based on our research, most older adults do not have a budget, but they do bank online and over 50% check their bank account and credit balances before making a purchase.

APPROACH

We started with a human-centered approach and listened to the people we serve. We held co-creation sessions with 50-64-year-old adults to understand their financial pain points and desires. We then collaborated with a research team, utilized the innovation process, led design thinking activities, and executed design sprints, allowing for rapid learnings and pivots to drive quick results.

Initially, I partnered with the Financial Resilience team to help gauge interest in a tool or service that would help older Americans take control of their finances by building and testing an online campaign. Realizing a deeper need for understanding the customer and building empathy early in the process, I took the lead on customer development, unpacking insights, prototyping, and testing.

EMPATHY

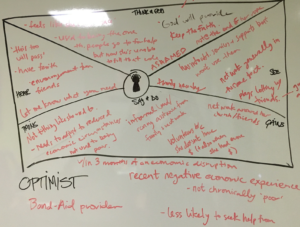

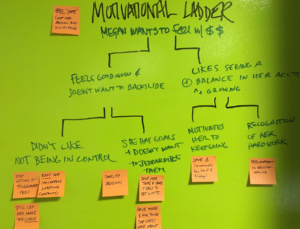

Based on earlier qualitative data collected, a deep dive of the ideal customer for the opportunity was conducted. Using the motivational ladder, empathy maps, and the value proposition canvas, we developed personas based on behavior and thinking styles.

Customer Insights and Ideation

Leading design sprints and co-creation sessions, we unpacked customer insights. The insights and learnings informed ideas for product designs that addressed customer motivations and behaviors.

EXPERIENCE STRATEGY and VISION

Journey maps, wireframes, and sketches were created to map the ideal experience.

DESIGN EXECUTION and VALIDATION

High-fidelity mobile app prototypes were created to share the product vision and future opportunities that align with the organization’s strategic initiatives. I moderated user interviews to test and refine the prototypes.

KEY INSIGHTS

- We can move quickly, but… As a small, corporate social innovation team, we were rather agile in our ability to design and test. Our dependencies within the organization don’t and sometimes can’t work at the same pace, which impacted our ability to test early assumptions.

- Having a low income doesn’t mean having a lack of spending power Most interview participants were willing to spend between $1 – $20 per month on a service that would help curb their spending

- Older adults actively use their smartphones There is a segment of the low-income population that bank online and on their mobile devices